What Is Year-Over-Year (YOY)?

Year-over-year (YOY)—sometimes observed as year-on-year—is a oftentimes used monetary comparison for staring at 2 or additional measurable events on Associate in Nursing annualized basis. perceptive YOY performance permits for gauging if a company’s financial performance is improving, static, or worsening. For example, you’ll browse in financial reports that a specific business reportable its revenues magnified for the third quarter, on a YOY basis, for the last 3 years.

KEY TAKEAWAYS

• Year-over-year (YOY) may be a technique of evaluating two or more measured events to check the results at one amount with those of a comparable amount on Associate in Nursing annualized basis.

• YOY comparisons are a preferred and effective thanks to judge the monetary performance of an organization.

• Investors seeking to determine a company’s financial performance use YOY reporting.

Also Read: WHAT IS DIGITAL SELLING MARKETING (DIGITAL MARKETING)?

Understanding YOY

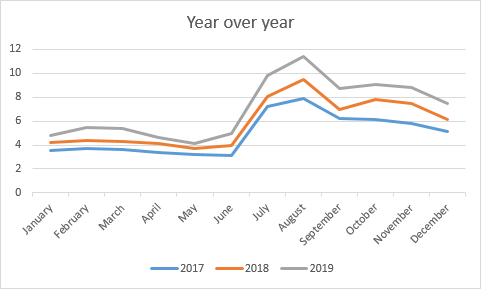

YOY comparisons are a popular and effective way to evaluate the financial performance of a company and also the performance of investments. Any measurable event that repeats annually are often compared on a YOY basis. Common YOY comparisons embody annual, quarterly, and monthly performance.

advantages of YOY

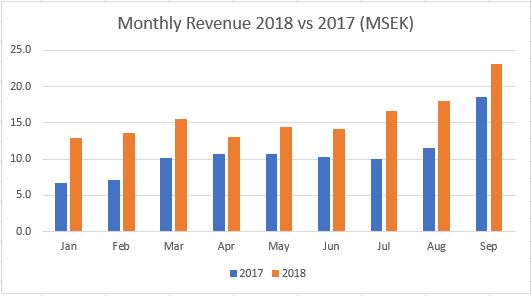

YOY measurements facilitate the cross comparison of sets of data. For a company’s first-quarter revenue exploitation YOY knowledge, a {financial Associate in Nursingalyst|securities analyst|analyst} or an capitalist will compare years of first-quarter revenue data and quickly ascertain whether or not a company’s revenue is increasing or decreasing.

For example, within the half-moon of 2021, the Coca-Cola corporation reportable a 5% increase in web revenues over the primary quarter of the previous year. By examination constant months in several years, it’s potential to draw correct comparisons despite the seasonal nature of shopper behavior.3 This YOY comparison is additionally valuable for investment portfolios. Investors wish to examine YOY performance to envision however performance changes across time.

Reasoning Behind YOY

YOY comparisons are common once analyzing a company’s performance as a result of they assist mitigate seasonality, an element which will influence most businesses. Sales, profits, and alternative monetary metrics amendment throughout different periods of the year because most lines of business have a high season and a coffee demand season.

For example, retailers have a peak demand season during the vacation searching season, that falls within the fourth quarter of the year. To properly quantify a company’s performance, it is sensible to check revenue and profits YOY.

It’s vital to compare the fourth-quarter performance in one year to the fourth-quarter performance in alternative years. If Associate in Nursing capitalist appearance at a retailer’s leads to the fourth quarter versus the previous third quarter, it would seem that an organization is undergoing new growth once it’s seasonality that’s influencing the distinction within the results. Similarly, during a comparison of the fourth quarter with the subsequent initial quarter, there might appear a dramatic decline, when this might even be a results of seasonality.

YOY conjointly differs from the term sequential, that measures one quarter or month to the previous one and permits investors to see linear growth. For instance, the quantity of cell phones a school company oversubscribed within the fourth quarter compared with the third quarter or the number of seats Associate in Nursing airline stuffed in Gregorian calendar month compared with December.

Real-World Example

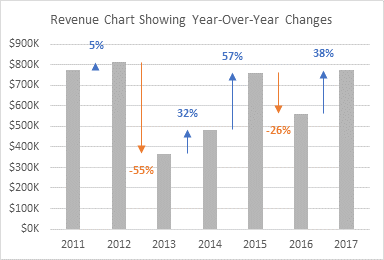

during a 2019 data system report, Kellogg Company discharged mixed results for the fourth quarter of 2018, revealing that its YOY earnings continuing to decline, even once sales magnified following company acquisitions. Kellogg foretold that adjusted earnings would come by an extra 5% to 7% in 2019 because it continued to speculate in alternate channels and pack formats.4

The company conjointly disclosed plans to reorganize its North America Associate in Nursingd Asia-Pacific segments, removing many divisions from the previous and reorganizing the latter into Kellogg Asia, Middle East, and Africa. Despite decreasing YOY earnings, the company’s solid presence and responsiveness to shopper consumption trends meant that Kellogg’s overall outlook remained favorable.4

what’s YOY Used For?

YOY is employed to create comparisons between just the once amount and another that’s one year earlier. this permits for an annualized comparison, say between third-quarter earnings this year vs. third-quarter earnings the year before. it’s unremarkably accustomed compare a company’s growth in profits or revenue, and it can even be accustomed describe yearly amendments in an economy’s cash supply, gross domestic product (GDP), and alternative economic measurements.

however Is YOY Calculated?

YOY calculations are simple and frequently expressed in share terms. this might involve taking the present year’s price and dividing it by the previous year’s value and subtracting one: (this year) ÷ (last year) – 1.

What’s the distinction Between YOY and YTD?

YOY appearance at a 12-month change. Year thus far (YTD) looks at a change relative to the start of the year (usually Jan. 1).

What If i’m fascinated by Comparisons for fewer Than a Year?

you’ll be {able to} figure month-over-month or quarter-over-quarter (Q/Q) in a lot of constant means as YOY. Indeed, you can opt for any time-frame you desire.

the basics of finance and Accounting

no matter your learning style, understanding corporate finance and accounting is simple after you can make a choice from 183,000 on-line video courses. With Udemy, you’ll be able to learn accounting nomenclature and the way to arrange monetary statements and analyze business transactions. What’s more, every course has new additions revealed each month and comes with a 30-day money-back guarantee.